Expert Advisors (EAs) have revolutionized Forex trading by enabling automated strategies that can operate 24/7 without human intervention. While EAs on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer numerous advantages, they are not foolproof. Traders often make mistakes when using these automated tools, leading to suboptimal performance or even significant losses. This article identifies common errors traders make when using MT4 and MT5 EAs and provides practical solutions to avoid these pitfalls.

1. Over-Reliance on Backtesting Results

One of the most common mistakes traders make is placing too much trust in backtesting results. Backtesting is a valuable tool for assessing an EA’s performance under historical market conditions, but it has limitations. Many traders assume that a strong backtest guarantees future success, which can lead to overconfidence.

Solution:

Understand that backtesting results are not definitive. They provide an indication of how the EA might perform, but they do not account for future market conditions, slippage, or broker-specific factors. To mitigate this, complement backtesting with forward testing on a demo account or a small live account to see how the EA performs in real-time conditions. This process, known as “walk-forward testing,” helps ensure the EA is robust and adaptable to current market dynamics.

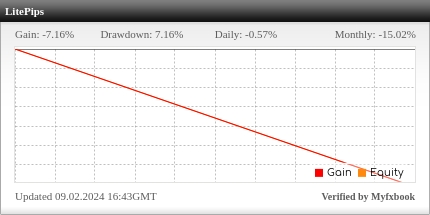

2. Neglecting to Monitor EAs Regularly

EAs are designed to automate trading, but that doesn’t mean they can be left completely unattended. Many traders make the mistake of setting up an EA and then neglecting to monitor its performance. Market conditions can change rapidly, and an EA that was profitable yesterday might start generating losses today if left unchecked.

Solution:

Even though EAs can operate independently, regular monitoring is essential. Set aside time to review the EA’s performance periodically—daily or weekly, depending on the trading frequency. Use the built-in alerts in MT4 and MT5 trading bot to notify you of significant events, such as when the EA opens or closes a trade, hits a drawdown limit, or deviates from expected performance. Regular monitoring allows you to intervene if the EA starts to perform poorly, thereby protecting your capital.

3. Ignoring Broker-Specific Conditions

Not all brokers are the same, and their trading conditions can significantly impact the performance of your EA. Factors such as spreads, execution speed, and slippage can vary widely between brokers, leading to different outcomes even when using the same EA.

Solution:

Before deploying an EA, thoroughly research the broker’s trading conditions. Look for brokers that offer tight spreads, low slippage, and fast execution times, as these factors are crucial for the EA’s success. Additionally, test the EA on a demo account with your chosen broker to see how it performs under real trading conditions. This step will help you identify any broker-specific issues that could affect the EA’s profitability.

4. Over-Optimization (Curve Fitting)

Over-optimization, also known as curve fitting, is the process of tweaking an EA’s parameters to fit historical data too precisely. While optimization can improve an EA’s performance, excessive fine-tuning can lead to an EA that performs exceptionally well on past data but fails in live trading because it is too tailored to historical patterns.

Solution:

Avoid the temptation to optimize every parameter. Focus on the most critical factors that genuinely impact the EA’s performance. When optimizing, use out-of-sample testing—where you reserve a portion of the historical data that wasn’t used in the optimization process—to see how the EA performs on unseen data. Additionally, consider using robust optimization techniques like Monte Carlo simulations to test the EA’s performance under various market scenarios and ensure it can handle different conditions.

5. Failing to Consider Market Conditions

Forex markets are influenced by various factors, including economic data releases, geopolitical events, and market sentiment. An EA designed for trending markets might struggle in a range-bound market and vice versa. Traders often make the mistake of deploying EAs without considering the current market environment.

Solution:

Before deploying an EA, assess the current market conditions. If your EA is designed for trending markets, ensure that the market is indeed trending. Conversely, if your EA works best in range-bound conditions, deploy it during periods of low volatility. You can also use multiple EAs tailored to different market conditions and switch between them as needed. Incorporating technical indicators that help identify market conditions, such as moving averages or the Average True Range (ATR), can also enhance the EA’s adaptability.

6. Setting Inappropriate Risk Parameters

Risk management is crucial in Forex trading, and EAs are no exception. One common mistake is setting risk parameters, such as lot size or stop-loss levels, that are too aggressive. This can lead to significant drawdowns or even account wipeout during periods of high market volatility.

Solution:

Use conservative risk management practices. Set a maximum percentage of your account balance that you are willing to risk on any single trade, typically no more than 1-2%. Ensure that your EA’s stop-loss levels are appropriate for the market conditions and the timeframe you are trading on. Consider using a trailing stop to lock in profits as the trade moves in your favor. Additionally, test different risk settings during the optimization process to find a balance between profitability and drawdown.

7. Lack of Diversification

Relying on a single EA to manage your entire trading portfolio is a risky strategy. No matter how well an EA has performed in the past, market conditions can change, and the EA may no longer be effective. Traders who fail to diversify their trading strategies are at risk of significant losses.

Solution:

Diversify your trading portfolio by using multiple EAs that operate on different currency pairs, timeframes, and market conditions. This approach spreads your risk across various strategies, reducing the impact of a single EA’s underperformance. You can also combine automated EAs with manual trading strategies to add another layer of diversification and control.

8. Ignoring Updates and Improvements

Technology and market conditions evolve, and so should your EAs. Traders often make the mistake of using outdated EAs that have not been updated to reflect current market conditions or technological advancements.

Solution:

Regularly check for updates or improvements to your EA, especially if you purchased it from a third-party provider. Developers often release updates to fix bugs, improve performance, or adapt the EA to new market conditions. If you have the programming skills, consider modifying the EA yourself to enhance its performance. Alternatively, hire a professional to make these adjustments. Staying up-to-date ensures that your EA remains relevant and effective in the ever-changing Forex market.

Conclusion

Using EAs in MT4 and MT5 can be a powerful way to automate your Forex trading strategy, but it’s essential to avoid common mistakes that can undermine their effectiveness. By being aware of and addressing issues such as over-reliance on backtesting, neglecting regular monitoring, and ignoring broker-specific conditions, you can significantly improve your chances of success. Additionally, by implementing proper risk management, diversifying your strategies, and staying updated with the latest advancements, you can optimize your use of EAs and enhance your overall trading performance. Remember, while EAs can automate many aspects of trading, they still require a thoughtful and informed approach to maximize their potential.