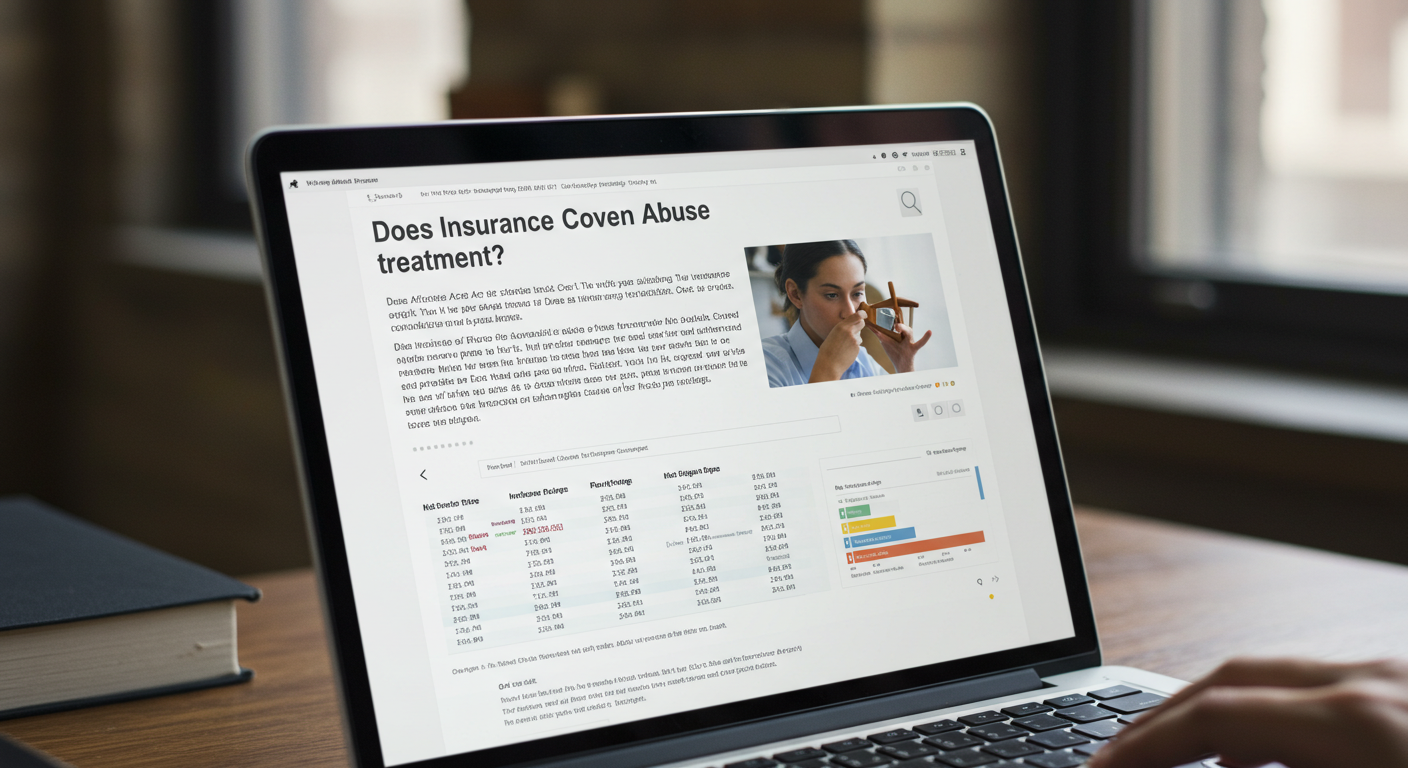

As the fight against substance abuse continues, many individuals and families grapple with the cost of treatment. Fortunately, in many cases, health insurance plans do provide coverage for substance abuse treatment, offering a lifeline for those seeking recovery. The journey to understanding and utilizing this coverage can be complex, and each insurance provider has their procedures and policies. In this article, we delve into the nuances of insurance plans, providing insights that could help you access the treatment you or a loved one needs. Keep reading to unravel how you can navigate these waters effectively.

Understanding Insurance Coverage for Substance Abuse Treatment

The landscape of insurance coverage for substance abuse treatment is extensive and varies considerably across different policies. Health plans typically cover an array of services, ranging from detoxification to outpatient therapy, under behavioral health services. However, the extent of this coverage is conditioned by the specifics of each plan, which might include network limitations, copays, and deductibles.

It is paramount for policyholders to comprehend the details of their insurance coverage, which can often be found in the Summary of Benefits and Coverage document. Familiarizing yourself with the terminology and criteria for coverage can help you advocate for the necessary treatments. Sometimes, preauthorization from the insurance provider is required, which entails an approval process before treatment can begin.

In some cases, insurers may cover only a portion of the treatment, or for a pre-specified duration, making it vital to understand potential out-of-pocket costs. Enrollment in certain state-funded or marketplace insurance plans could offer more expansive coverage options, thanks to the regulations of the Affordable Care Act (ACA). For instance, Cigna substance abuse coverage may vary from other providers, with their own particular stipulations regarding substance abuse treatment.

Navigating Insurance Plans: What to Look for Regarding Substance Abuse Treatment

When assessing your insurance for substance abuse treatment coverage, closely examine the list of in-network providers. Staying within this network can significantly reduce your out-of-pocket costs. Additionally, review the requirements your insurance company may have regarding referrals or preauthorizations. Some plans necessitate a doctor’s referral or a formal recommendation for treatment.

Understanding your plan’s deductible and out-of-pocket maximum is crucial. These are the amounts you’re responsible for before your insurance coverage kicks in fully and the maximum you would pay in a policy period, respectively. Co-pays and coinsurance rates, the fixed fees or percentages you pay for services, should also be evaluated as they directly impact your financial responsibility.

You should also consider the treatment settings your insurance plan covers. Coverage can be expansive to include residential, inpatient, outpatient, and even telehealth services for those unable to attend in-person sessions. It’s prudent to explore whether your insurance supports multi-faceted treatment approaches, such as combining therapy with medication-assisted treatment (MAT).

The Role of the ACA in Substance Abuse Treatment Coverage

The ACA has significantly impacted the coverage of substance abuse treatment. The ACA mandates that Medicaid and all health insurance marketplace plans must cover substance use disorder services, making them essential health benefits. This requirement has expanded access to treatment for millions and has helped normalize substance use disorder as a treatable medical condition.

Thanks to the ACA, insurers can no longer deny coverage based on pre-existing conditions, which include substance use disorders. Furthermore, coverage under the ACA must also encompass behavioral health treatment, including psychotherapy and counseling. This fosters a more comprehensive approach to the treatment of substance abuse.

Steps to Take if Your Insurance Denies Substance Abuse Treatment Coverage

If you are faced with a denial of coverage for substance abuse treatment, the first recommended step is to thoroughly review the denial letter. It should outline the reasons for the refusal and provide information on how to appeal the decision. Understanding the denial’s basis is crucial to effectively countering it.

An appeal to your insurance company is often the next course of action. The appeals process typically starts with an internal review, where you dispute the denial with your insurer directly. If this doesn’t yield results, an external review by an independent third party can be pursued. It’s important to provide ample documentation to support your appeal, including medical records and letters from your healthcare provider detailing the necessity of treatment.

Altogether, understanding and utilizing your insurance for substance abuse treatment requires diligence and advocacy. Whether you are reviewing the types of treatments covered, discerning your policy’s specific provisions, or fighting a denial of coverage, it is essential to be well-informed and proactive. Overall, the journey towards recovery can be made more manageable with the support and coverage of a suitable health insurance plan.