In this fast-paced world, enhancing customer experience by giving them a seamless and unvexed payment process is crucial for every business. In order for a business to be able to accept card payments over the internet, and face-to-face in a retail setting credit card processing and merchant services are indispensable, as they serve as the backbone of this structure. So how are you supposed to decide on what the best solution for your business is?

This blog will help you understand what credit card processing and merchant services are, why they matter, and how they can be beneficial for your business.

Credit Card Processing: What is it?

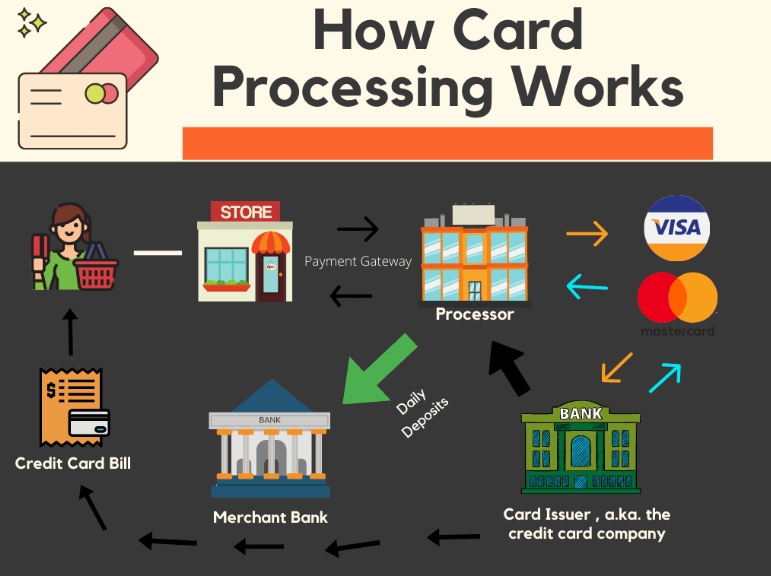

By definition, credit card processing is the method of transferring funds that are available in a customer’s account from an active bank account when the customer makes an order with his credit or debit card. This process has multiple steps: authorizing the transaction, checking out cardholder information and sending the payment to merchant bank account. A solid credit card processing system is vital for businesses, ensuring that sales are fast, secure, welcoming and most importantly convenient for your customers.

What Are Merchant Services?

Merchant services are the financial services required for carrying out transactions, such as accepting and processing payments. Those services commonly include payment gateways, point of sale (POS) systems) and merchant account management. Merchant service providers are the intermediaries between businesses, banks and credit card networks whose goal is to help the flow of transactions.

Additional features such as fraud detection, chargeback management, and payment security measures are part of the merchant services that can help businesses securing their business and customers.

Selecting a Merchant Services Provider

Below are few aspects to consider while choosing a merchant services provider:

Transaction fees — As with most services there are going to be costs, and this is where the costs of different providers can vary, processing fees.

Security: You want to have the best fraud protection with solid data encryption as well.

Integrates Seamlessly: Your merchant services should be able to integrate with your existing systems, such as eCommerce platforms or POS software.

Customer Support (a must when it comes to dealing with payment disputes)

How RapidCents Can Help

RapidCents —Led by CEO, Mani Rahnama— one of the fresh bloods in the payment realm. Secure Credit Card ProcessingTailored To Your Business RapidCents offers credit card processing solutions designed for any business, regardless of size. It enables businesses to reduce transaction costs through their merchant services and provide sophisticated fraud prevention measures.

Conclusion

Credit card processing and merchant services are important aspects of doing business in today›s market. The best payment service providers will allow you to provide seamless, reliable, and effective payment methods for your customers, leading to more sales and happier customers. Your payment process is an important part of your business, and if you are running a small business from a home office or you have a large enterprise with multiple locations or even manufacturing sites, the right merchant services can help you streamline things.