Millennials and Gen Z face a unique financial landscape—student loans, the gig economy, and a world that often values experiences over assets. Yet, these generations are brimming with potential, eager to carve their own paths. This isn’t about penny-pinching or sacrificing your favorite latte. It’s about smart, empowering choices that set the stage for financial freedom and the life we envision.

Mastering Your Mindset: The Financial Foundation

Money isn’t just about numbers; it’s intrinsically linked to our emotions and beliefs. Have you ever noticed how two people with the same income can have vastly different financial outcomes? That’s the mindset at play.

- Shift from Scarcity to Abundance: Instead of focusing on what you lack, train your mind to see opportunities. Abundance isn’t about denying challenges; it’s about believing solutions exist.

- Embrace Learning: Financial literacy isn’t taught in most schools, yet it’s crucial. Read books, listen to podcasts, follow experts—invest in your financial education.

- Visualize Success: What does financial freedom look like for you? A home? Travel? Early retirement? Creating a vivid picture fuels your motivation.

Matt Mayerle, personal finance editor at CreditNinja.com, emphasizes, “Your financial mindset is the foundation of your success. Shifting from a scarcity mindset to one of abundance can transform how you approach money and opportunities.”

Budget Like a Boss: Your Financial Blueprint

Imagine building a house without a blueprint. Chaos, right? That’s what life without a budget feels like. It’s not about restriction; it’s about intention.

- Track Your Spending: You’d be surprised where your money goes. Use apps, spreadsheets, or the good old pen-and-paper method.

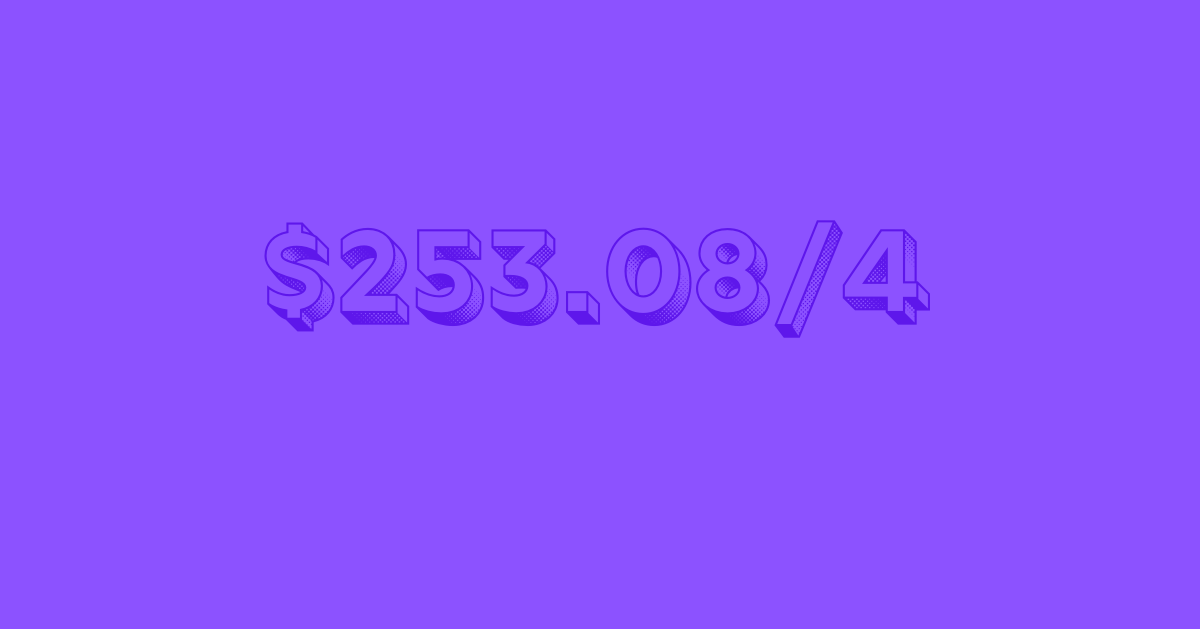

- Set Realistic Goals: Want to save for a down payment or that dream trip? Break it down into achievable monthly targets.

- Review and Adjust: Life changes, and so should your budget. Make it a habit to review and tweak it regularly. Maximize Your Savings with the best cd rates now – Secure Higher Returns Today!

Side Hustles and Savings: Supercharging Your Income

Think of your income as a car. You can cruise along, or you can add a turbocharger. Side hustles are that extra boost, whether it’s freelancing, driving for a rideshare app, or monetizing a hobby.

- Explore Your Passions: What are you good at? What do you enjoy? There’s likely a way to turn it into income.

- Automate Savings: Make saving effortless. Set up automatic transfers to a separate account and watch it grow.

- Consider High-Yield Savings Accounts: Don’t let your money just sit there. Look for accounts that offer higher interest rates.

Investing for the Future: Planting Seeds of Wealth

Investing might seem intimidating, but it’s a powerful tool for long-term financial growth. Think of it as planting seeds that will bear fruit in the future.

- Start Early: Time is your greatest ally. The earlier you start, the more your money can grow through compound interest.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across different asset classes to manage risk.

- Seek Guidance: Consult a financial advisor if you need help figuring out where to start. They can help you create a personalized plan.

Matt Mayerle also advises, “Starting early with investing can significantly impact your financial future. The power of compound interest cannot be overstated—it truly is the key to growing wealth over time.”

Debt Management: The Road to Financial Freedom

Debt can feel like a heavy burden, but with a strategic approach, you can regain control.

- Prioritize High-Interest Debt: First, focus on paying off debts with the highest interest rates, such as credit cards or debit card loans.

- Create a Repayment Plan: Set a timeline and stick to it. Celebrate each milestone along the way.

- Explore Consolidation Options: If you have multiple debts, consolidating them into one loan with a lower interest rate might simplify repayment.

Conclusion: Your Financial Future Awaits

You have the power to shape your financial destiny. Embrace a growth mindset, create a budget that aligns with your goals, boost your income with side hustles, invest wisely, and manage debt strategically. Remember, it’s not about perfection; it’s about progress. Every step you take brings you closer to financial freedom and the life you truly desire. So, start today and watch your financial future bloom.