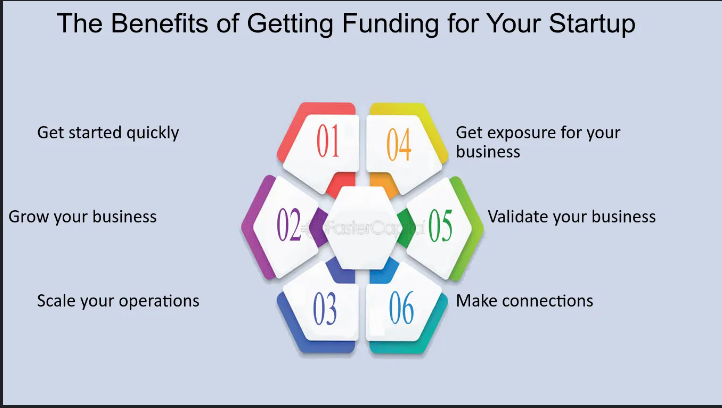

Unveiling the Advantages

In the dynamic business world, securing adequate funding is a pivotal step that can dictate the trajectory of a new venture. While traditional funding routes like bank loans or public offerings are standard, private funding emerges as a compelling alternative, offering a spectrum of benefits particularly appealing to startups and growing businesses. This funding method involves securing capital from private investors, venture capital firms, or angel investors, who provide financial backing in exchange for equity, profit participation, or debt repayment.

Tailored Financial Solutions

Flexibility in Funding

One of the most significant advantages of private funding is its flexibility. Unlike the rigid loan structures offered by conventional banks, private investors often provide more adaptable financing options that can be customised to meet the unique needs of a business. This flexibility can be crucial for startups that require bespoke financial solutions to navigate the early and typically volatile stages of business development. Investors in this domain are more willing and often eager to tailor the terms of funding to align with the business’s growth projections and existing market conditions. They understand the unpredictable nature of startups and are prepared to offer terms that can accommodate fluctuating revenues, unexpected costs, and other financial uncertainties that traditional lenders typically avoid. This approach can significantly enhance a startup’s ability to adapt and thrive in competitive markets.

Speed of Access

Another key benefit of private funding is the speed at which funds can be accessed. Traditional financial institutions require extensive paperwork, adherence to strict guidelines, and often lengthy approval processes. In contrast, private funding can be secured much faster, often within weeks. This rapid turnaround can be invaluable for businesses needing to capitalise on market opportunities or address sudden financial needs.

Enhancing Business Growth

Strategic Partnerships

When entrepreneurs engage with private investors, they gain more than just financial backing. Many private investors bring industry experience, valuable insights, and strategic advice. This relationship can transform them into invaluable partners who actively contribute to the company’s strategic direction. Moreover, their involvement can open doors to networking opportunities, potential clients, and partnerships that might otherwise be inaccessible.

Increased Operational Autonomy

Businesses funded by private investors often enjoy more operational freedom compared to those dependent on public funding or strict bank loans. While investors expect a return on their investment, they may provide more leeway in conducting business operations if the company moves towards profitability and growth. This autonomy can empower entrepreneurs to make decisions they believe are in the company’s best interest without the constant oversight typical of traditional funding sources.

Mitigating Financial Risks

Diversification of Funding Sources

Relying solely on traditional funding sources can expose a business to significant financial risk, especially during an economic downturn. Private funding allows companies to diversify their funding sources, spreading out risk and reducing dependence on unpredictable market conditions. With multiple funding avenues, businesses can secure a more stable financial footing and enhance their ability to weather economic storms.

Long-term Commitment

Private funding often comes with a long-term commitment from investors deeply interested in seeing a business grow and succeed over an extended period. This extended timeline can be crucial for new companies that need ample time to develop their products or services, refine their business models, experiment with market strategies, and scale their operations effectively without the pressure of short-term repayments. Investors in this arena are typically patient and supportive, understanding that substantial returns can materialise. They are often more concerned with sustainable growth and long-term profitability rather than quick financial gains, which allows entrepreneurs to focus on innovation and quality, thereby laying a solid foundation for the future success of their business.

Conclusion: A Gateway to Innovative Growth

Private funding stands out as a robust option for business ventures, characterised by its flexibility, speed, and the strategic value it adds. By choosing private funding, entrepreneurs secure financial resources and gain access to a network of experienced professionals who can offer guidance and open doors to new opportunities. As businesses strive to innovate and grow in competitive markets, private funding provides a pathway that supports ambitious goals with a personalised touch, underscoring its importance in the modern financial landscape. Whether it’s a startup looking to disrupt an industry or a growing business aiming to expand, private funding can provide the tools necessary to turn visions into realities.